November 15, 2016: Laurence Parisot, today announces the planned sale of a 100% interest in IFOP to Dentressangle Initiatives,in partnership with Pierre Pigeon and A+A Research. The plan is to create a leading French operator in the market research sector.If the acquisition is successful, the combination of A+A and IFOP would lead to the creation of a new French mid-tier service provider in the opinion poll and market research sector, with revenues of Û60 million and 300 employees. Each company would retain its independence and management team. A+A Chairman Pierre Pigeon would also be appointed chairman of IFOPÕs Supervisory Board, while StŽphane Truchi would remain chairman of the Executive Board.

A+A chairman Pierre Pigeon ÒThis is a growth plan based on the complementarity of A+A Research and IFOPÕs businesses; both companies enjoy a high level of recognition on their respective markets. This transaction would enable both companies to join forces in order to achieve the critical mass required to meet the challenges posed by international expansion and R&D in Big DataÓ. Founded in 1989, the A+A Group is a recognised expert in market studies for the pharmaceutical industry and has become a major operator in its market with a strong international focus. The Group is headed by co-founder Pierre Pigeon, a consultant endocrinologist who moved into the pharmaceutical industry via international marketing. Following its recent acquisition of Bell Falla in the US, A+A now has 140 employees working from the GroupÕs offices in Paris, Lyon (Management and International Division), London, New York, Norwalk (CT) and Thousand Oaks (CA). A+A Research generates 65% of its revenues outside France (primarily in the US) and carries out research in over 60 countries for most global pharmaceutical companies.

- Company Name:Aplusa

(View Trends)

-

Headquarters: (View Map)Lyon, France

-

Market Research

-

50 - 200 employees

- 184366 Global Rank

- 46030 Germany

- 145 K Estimated Visits

-

Referrals83.92%

-

Direct9.65%

-

Mail4.51%

-

Social1.10%

-

Search0.42%

-

Display0.40%

-

22.41%

-

20.03%

-

19.39%

-

9.71%

-

8.88%

- 10 SDKs

- 4.9 Avg. Rating

- 1 Total reviews

- App Url: https://itunes.apple.com/app/aplusa/id411884947

- App Support: http://www.aplusaresearch.com/

- Genre: Business

- Bundle ID: com.aplusaresearch.aplusastats

- App Size: 22.9 M

- Version: 2.3.1

- Release Date: December 28th, 2010

- Update Date: April 18th, 2020

Description:

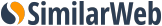

3 common statistical tools used to analyze market research results:

1 - CONFIDENCE INTERVAL CALCULATOR

2 - COMPARING TWO PERCENTAGES

3 - SAMPLE SIZE CALCULATOR

-----------------------------------------

1 - CONFIDENCE INTERVAL CALCULATOR

Level of accuracy in percentages observed:

To conduct market research is to interview (or observe) a sample of individuals. The larger the sample, the greater the statistical accuracy. Confidence interval provides the level of accuracy of a given measure.

FOR INSTANCE

Upon interviewing a sample of 500 GP’s, 20% are found to be using Product A. So, what is, within the total population, the actual proportion of users of Product A.

Assuming 5% risk level*, confidence interval is:

• 20% +/-3.5

• [16.5%-23.5%]

In other words, there is a 95% probability that the actual percentage of Product A users in the total population of GPs is between 16.5% and 23.5%.

-------------------------------------

2 - COMPARING TWO PERCENTAGES

Statistical significance between 2 observed percentages:

When comparing opinions (or attitudes) measured on two samples, a significance test is applied. Significance tests provide an indication whether observed percentages are significantly different or not.

FOR INSTANCE

Upon interviewing a sample of 500 GP’s, 20% are found to be using Product A. Equally, upon interviewing a sample of 150 cardiologists, 25% of those are found to be using Product A. Would such a result suggest that a larger proportion of cardiologists is using Product A?

At 5% risk level*, the two percentages observed on these samples are not statistically different.

In other words, there is a 95% probability that the actual proportion of Product A users among GPs’ total population is similar to the actual proportion of Product A users among cardiologists’ total population.

-------------------------------

3 - SAMPLE SIZE CALCULATOR

Minimum sample size calculations:

By taking into account an expected percentage, as well as the corresponding confidence interval, it is possible to calculate the sample size needed for a given market research survey.

This application calculates the minimum sample of respondents needed in order to achieve the required level of research accuracy.

FOR INSTANCE

Research is needed to evaluate the level of use of Product A among anaesthetists. The desired confidence interval is +/-8. Approximately one third of anaesthetists is expected to be using Product A.

How many anaesthetists need to be interviewed in order to achieve this margin of error?

At 5% risk level*, for an expected percentage of 33%, with a confidence interval of +/-8, minimum sample size is 133 anesthetists.

In other words, if you interview a minimum of 133 anesthetists, there is a 95% chance to get a confidence interval of +/-8 if the proportion of Product A users in the anesthetist sample is 33%.

Sort by

Procastinator11

Simple and great