IDBI Bank Ltd. is the youngest, new generation, public sector Universal Bank with its operations driven by a cutting edge core Banking IT platform. The Bank offers personalized banking and financial solutions to its clients in the retail and corporate banking arena through its large network of Branches and ATMs, spread across length and breadth of India.

IDBI Bank has also set up an overseas branch at Dubai and have plans to open offices in various other parts of the Globe, for encashing emerging global opportunities.

Our vision for the Bank is ÒTO BE THE MOST PREFERRED AND TRUSTED BANK ENHANCING VALUE FOR ALL STAKEHOLDERSÓ.

Mission:

¥ Delighting customers with our excellent service and comprehensive suite of best-in-class financial solutions;

¥ Touching more people's lives with our expanding retail footprint while maintaining our excellence on corporate and infrastructure financing;

¥ Continuing to act in an ethical, transparent and responsible manner, becoming the role model for corporate governance;

¥ Deploying world class technology, systems and processes to improve business efficiency and exceed customerÕs expectations;

¥ Encouraging a positive, dynamic and performance-driven work culture to nurture employees grow them and build a passionate and committed work force;

¥ Expanding our global presence;

¥ Relentlessly striving to become a greener bank.

- Company Name:Idbi Bank

(View Trends)

-

Headquarters: (View Map)Mumbai, India

-

Banking

-

> 10,000 employees

- 1508389 Global Rank

- 89075 India

- 460 K Estimated Visits

-

Direct95.05%

-

Search4.12%

-

Referrals0.84%

-

Display0.00%

-

Mail0.00%

-

Social0.00%

-

100.00%

- Mount Sterling

- 10 SDKs

- 1.86 Avg. Rating

- 3 Total reviews

- App Url: https://itunes.apple.com/app/idbi-bank-1/id1109435235

- App Support: http://www.idbi.com/

- Genre: Finance

- Bundle ID: com.idbi.Mbanking

- App Size: 12.2 M

- Version: 1.0

- Release Date: May 19th, 2016

- Update Date: May 19th, 2016

Description:

Registering for the Mobile Banking App couldn’t be easier and takes less than 5 minutes. You simply download it, just like you would any other iOS app from Apple Store for all iOS based devices. Activate the Mobile Banking App (one-time activity) by first visiting www.idbibank.com and authenticating your Debit Card credentials. You will then be prompted to set a temporary PIN which can be used to activate the App on your mobile handset.

Before activating the Mobile Banking App, please ensure to first register for the mobile banking channel, by either submitting a channel registration form at the Branch or by opting for the service through your Internet Banking account.

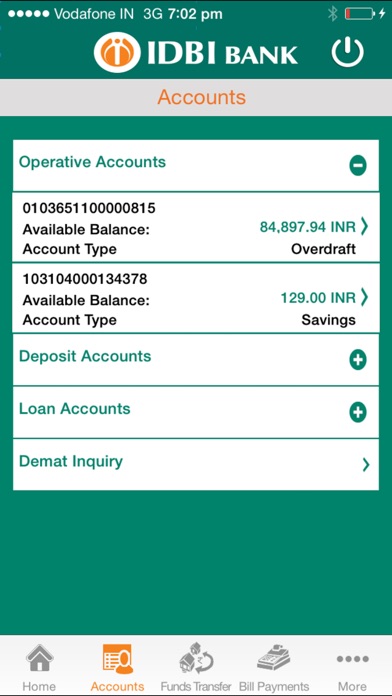

A user can view their account statements on the go at their convenience, even while work or commuting. Checking the balance in your account, managing and scheduling utility bill payments, adding a top-up in your prepaid mobile phone or DTH account, paying VISA credit card bills, or instantly transferring money from one bank account to another through IMPS (Immediate Payment Service) is now possible at the click of just a few buttons on your phone.

Banking through the Mobile App not only saves you time or a visit to the Bank, but also reduces the risk of fraud. Every transaction or beneficiary addition requires a dynamic OTP (one- time- password) authentication. A user will also get an SMS alert whenever a transaction is initiated in your account, through any alternate banking channel like ATM, Point of Sale (POS), Internet or Mobile Banking.

The following Key services can be now be easily accessed from your mobile handset:

• Account Balance Enquiry.

• Account Statement Enquiries.

• Cheque Status Enquiry / Stop Payment.

• Cheque Book Requests.

• Fund Transfer between Accounts within the Bank and to other Banks (NEFT).

• Instant Funds Remittance through IMPS ( Immediate Payment Service).

• Utility Bill Payments.

• Mobile and DTH Recharge.

Security:

We take every step to keep the account safe and secure when banking on the mobile device. IDBI Bank uses sophisticated encryption technology for secure data transfer from your mobile phone to the Bank’s mobile banking server. The MPIN created by the user, is securely encrypted on the mobile handset itself ad MPIN does not travel over the air. No account information or any other account sensitive credentials is stored on your mobile phone, making it completely safe and secure.

Sort by

DareDevil26

IDBI Victim

Worst App-Worst Bank

Abmish21

Pathetic and Non Functional

Launch Services

Launch Services

Core Foundation Framework

Core Foundation Framework

Core Graphics

Core Graphics

Core Location Framework

Core Location Framework

Foundation Framework

Foundation Framework

MapKit

MapKit

Quartz Core Framework

Quartz Core Framework

Security Framework

Security Framework

System Configuration F...

System Configuration F...

UIKit

UIKit

-

Standard0%

-

Direct0%

Pathetic App