About Kotak Mahindra Group:

Established in 1985, the Kotak Mahindra Group is one of IndiaÍs leading financial services conglomerates. In February 2003, Kotak Mahindra Finance Ltd. (KMFL), the GroupÍs flagship company, received a banking license from the Reserve Bank of India (RBI). With this, KMFL became the first non-banking finance company in India to become a bank _ Kotak Mahindra Bank Limited.

The consolidated balance sheet of Kotak Mahindra Group is over 1 lakh crore and the consolidated net worth of the Group stands at 13,943 crore (approx US$ 2.6 billion) as on September 30, 2012.

The Group offers a wide range of financial services that encompass every sphere of life. From commercial banking, to stock broking, mutual funds, life insurance and investment banking, the Group caters to the diverse financial needs of individuals and the corporate sector. The Group has a wide distribution network through branches and franchisees across India, and international offices in London, New York, California, Dubai, Abu Dhabi, Bahrain, Mauritius and Singapore. For more information, please visit the companyÍs website at http://www.kotak.com

- Company Name:Kotak Mahindra Bank

(View Trends)

-

Headquarters: (View Map)Mumbai, India

-

Banking

-

> 10,000 employees

- 6784 Global Rank

- 405 India

- 9.02 M Estimated Visits

-

Direct58.09%

-

Search26.50%

-

Referrals12.09%

-

Mail1.83%

-

Social0.84%

-

Display0.65%

-

94.32%

-

1.67%

-

0.93%

-

0.47%

- India 96.6%

- United States 1.8%

- Cable Networks

- 10 SDKs

- 4.77 Avg. Rating

- 630 Total reviews

- App Url: https://itunes.apple.com/app/kotak-mahindra-bank-1/id622363400

- App Support: http://www.kotak.com/bank/personal-banking/convenience-banking/mobile-banking.html

- Genre: Finance

- Bundle ID: com.kotak.kmb

- App Size: 182 M

- Version: 5.1.6

- Release Date: April 18th, 2013

- Update Date: June 14th, 2021

Description:

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

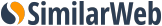

If you are an existing Kotak customer, you can use the 100+ features of the app to Bank, Pay bills, Invest, Shop and access services.

• Bank on the go:

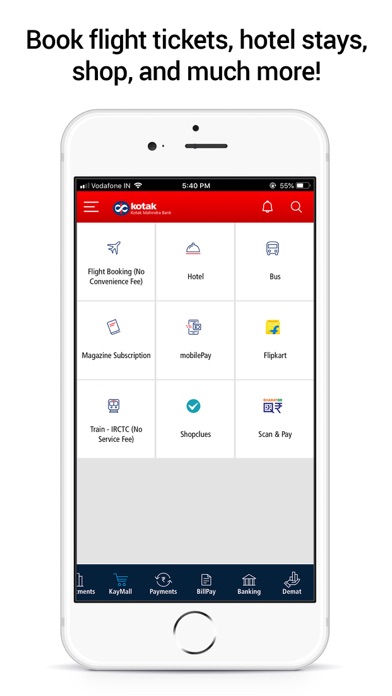

Manage all your financial transactions, send and receive money through NEFT, IMPS and RTGS & UPI, request for a cheque book and much more

• Shop at your fingertips:

Dive into KayMall and shop via Flipkart, book flights and hotel rooms via Goibibo and book train tickets via IRCTC and much more

• Pay your bills:

Pay your Mobile Recharge, DTH payments and other bills with the online BillPay feature. Also, use the AutoPay feature to remember your monthly bills and pay them automatically from your account. Never miss a deadline again

• Services:

Instant completion on requesting for services such as updation of profile details, switching on/off of your Debit/Credit Card online

There's a lot more you can do with our Mobile Banking App:

• Transfer money instantly using BHIM UPI without the need for any bank information

• Transfer funds easily on the go without registering a beneficiary

• Book train tickets using IRCTC, shop on Flipkart, goibibo and more in KayMall

• Recharge your mobile & DTH subscriptions with ease

• Purchase and redeem Mutual Funds and keep track of your investments

• Apply for a Kotak Credit Card

• Regenerate your Debit and Credit card PINs

• In case of loss, temporarily switch off your Kotak Debit Card for security purpose

• Pay Credit Card bill online

• Check your Bank Account statement

• Check your account balance

• Pay your bills, open a Term Deposit

• Post opening Account, go to Manage Profile and Click a selfie or upload your photo to set as profile picture

Get started:

To get started, you just need your Customer Relationship Number (CRN), your Debit / Credit Card PIN or your Net Banking password to get started. The app will take you through a one-time activation process when you login for the first time.

Kotak Bank App requires following permissions:

- Contacts: This is required to allow you fetching mobile number while mobile / DTH recharge or sharing IFSC/MMID

- Location: This is required for Branch / ATM locator

- Photos / Media / Files / Camera: This is required to let you access gallery / click an image to set profile picture.

- Phone: This is required to let you dial customer contact center

- SMS: This is required to auto activate the device during activation process.

Please note that your data is safe with Kotak Mahindra bank. We do not share any information with third party without your initiation.

Sort by

Paras Joshi

Suribabu pedireddi

Not working

Dchabarwal

D

Khosa34

Nice

Psspsharma

Nice aap

Dpk007sngh

*****

-

Native18.72%

-

Standard80.30%

-

Direct0.99%

They are headquartered at Mumbai, India, and have 15 advertising & marketing contacts listed on Kochava. Kotak Mahindra Bank works with Advertising technology companies such as DoubleClick.Net, Google Adsense, Facebook Custom Audiences, AppNexus, Bizo, LinkedIn Ads, IponWeb BidSwitch, DoubleClick Bid Manager, Google Remarketing, Pubmatic, Rubicon Project, Adobe Audience Manager Sync, DemDex.

One of the best app for banking purpose