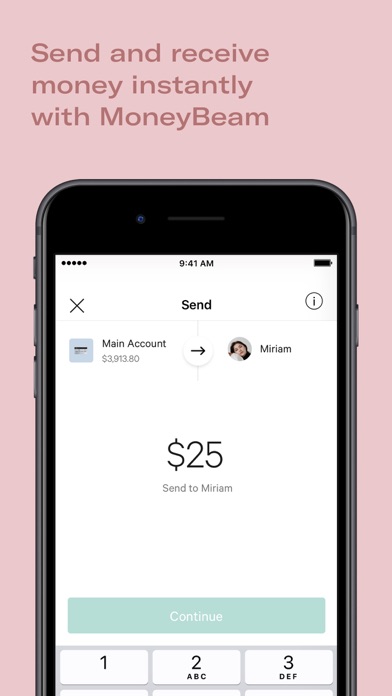

N26 is EuropeÕs first Mobile Bank with a full European banking license and is setting new standards in banking. N26 has redesigned banking for the smartphone, making it simple, fast and contemporary. Opening a new bank account takes only eight minutes and can be done directly from your smartphone. Users receive a Mastercard to pay cashless or withdraw cash all around the world. They can block or unblock their card with a simple click and send money instantly to friends and contacts.

N26 was founded in early 2013 by Valentin Stalf and Maximilian Tayenthal. In two years N26 has acquired more than 500.000 clients. It operates in 17 countries: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain and currently employs 350+ people. Since January 2015, N26 has been available for Android, iOS, and desktop. N26 has raised more than $55 million from investors including Li Ka-ShingÕs Horizons Ventures, Battery Ventures and Valar Ventures, in addition to members of the Zalando management board, Earlybird Venture Capital and Redalpine Ventures.

- Company Name:N26

(View Trends)

-

Headquarters: (View Map)Berlin, Germany

-

Financial Services

- Germany 39.1%

- France 10.2%

- Spain 8.9%

- Italy 6.3%

- Switzerland 5.5%

- Shanghai

- 10 SDKs

- 4.79 Avg. Rating

- 5.86 K Total reviews

- App Url: https://itunes.apple.com/app/number26-gmbh/id956857223

- App Support: https://support.n26.com/en-us?utm_source=appstore&utm_medium=description

- Genre: Finance

- Bundle ID: de.no26.Number26

- App Size: 350 M

- Version: 3.62

- Release Date: February 4th, 2015

- Update Date: June 15th, 2021

Description:

Want fast, simple, secure banking with no hidden fees? Meet N26. Open a bank account in 5 minutes from your phone and experience mobile banking the world loves.

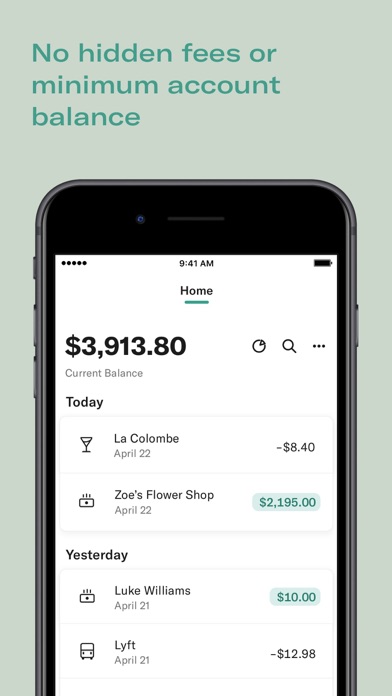

No hidden fees

Open a 100% mobile bank account in 5 minutes directly from your phone and experience banking with zero hidden fees. Yes, that’s right — no maintenance charges, no insufficient funds fees, and no minimum account balance.

Get cashback automatically

Save money on gas, groceries, fashion, travel and more with N26 Perks. You’ll earn cashback when you pay with your N26 debit card at thousands of participating businesses, including brands you love like Walmart+, Marathon, Converse, Adidas, and more.

Get paid up to 2 days early¹

You’ll receive your paycheck and other direct deposits up to 2 days early with your N26 debit card.

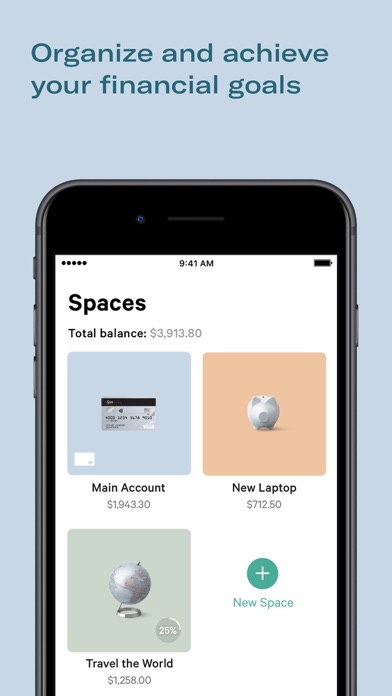

Save and budget with Spaces

Set savings targets and save money with just a few taps. Supercharge your savings by automatically rounding up your purchases to the nearest dollar.

Free cash withdrawals

Unlimited free ATM withdrawals at over 55,000 Allpoint ®locations. Plus, we’ll reimburse you for 2 out-of-network withdrawals each month — anytime, anywhere in the US.

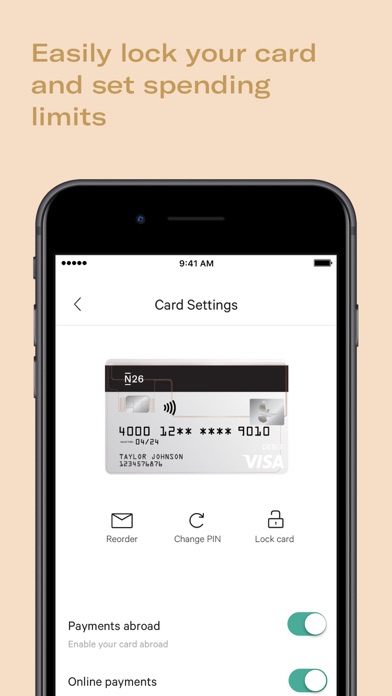

Banking you control

Manage money directly from your banking app. Instantly lock or unlock your Visa card if it’s lost, set spending limits to avoid overspending, reset your PIN, enable international payments and more.

Safety and security

Your N26 account is FDIC-insured, so you can breathe and bank easier. And with N26, you’re protected from fraudulent purchases with Visa's Zero Liability policy.²

Real-time alerts

Receive instant notifications on all account activity so you know what’s happening with your account 24/7.

Contactless payments

Experience fast and secure cashless payments with Apple Pay®.

¹ Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay the availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instructions.

² Visa’s Zero Liability Policy covers U.S.-issued cards only and does not apply to certain commercial card transactions or transactions not processed by Visa. You must notify your card issuer immediately of any unauthorized use. For specific restrictions, limitations and other details, please consult your issuer.

Apple and Apple Pay are trademarks of Apple Inc. For a list of compatible Apple Pay devices, see support.apple.com/km207105.

N26's cashback offers are powered by Dosh. View terms and conditions at n26.com/en-us/perks

The N26 Account is offered by Axos Bank ®, Member FDIC. N26 is a service provider of Axos Bank. All deposit accounts of the same ownership and/or vesting held at Axos Bank are combined and insured under the same FDIC Certificate 35546. All deposit accounts through Axos Bank brands are not separately insured by the FDIC from other deposit accounts held with the same ownership and/or vesting at Axos Bank. The N26 Visa ® Debit Card is issued by Axos Bank pursuant to a license by Visa U.S.A. Inc. The N26 Visa Debit Card may be used everywhere Visa debit cards are accepted.

N26 Inc. does not currently offer or provide banking services on its own behalf or for its affiliates and is not a bank. N26 Inc. is wholly owned by N26 GmbH, which is also the parent company of N26 Bank GmbH. N26 Bank GmbH is a non-US bank, is not FDIC-insured, and does not offer or provide banking services in the United States or to US residents.

Sort by

BradleyRoby1980

Aphofis

Widget weg , Verfügbarer Rahmen weg….

iMaxBlack

Widget sparito.

sacche76

Ottima banca

Hyperdruide

Efficacité

CyalNaru

Trop facile

-

Native97.73%

-

Standard1.34%

-

Direct0.93%

They are headquartered at Berlin, Germany, and have advertising & marketing contacts listed on Kochava. N26 works with Advertising technology companies such as Google Adsense for Domains, Google Adsense, Twitter Ads, Facebook Custom Audiences, DoubleClick.Net, Taboola, The Trade Desk, Index Exchange, Advertising.com, Adap.TV, IponWeb BidSwitch, AppNexus, Yahoo Small Business, Rubicon Project, ExactTarget.

Widget transactions preview.