Founded in 1993, Platinum Home Mortgage is a nationwide lender offering more home financing options than any other direct lender. As a direct lender, there is no middle-man and all loans are processed, underwritten and funded in-house. For our customers, this means a straight forward, faster process.

At Platinum Home Mortgage, we put our customerÕs best interests first and strive to make the home financing process a great experience.

Being innovative is how we separate ourselves from other lenders. It is through our innovation, that we are able to offer more mortgage programs than anyone else, providing us with more ways to work in the customerÕs best interest.

Our mortgage consultants are educated and experienced and we ensure that they remain the best with ongoing training and staying current in an ever-changing industry. We learn faster than our competition, which pays off for our customers.

We are committed to integrity, excellence and professionalism in everything we do and to supporting the communities in which we do business. Find out how Platinum can make a difference in your life.

Check out what some of our PHMC Team has to say: https://www.youtube.com/c/Phmc1

- Company Name:Platinum Home Mortgage (nmls Id #13589)

(View Trends)

-

Headquarters: (View Map)Rolling Meadows, IL, United States

-

Financial Services

-

200 - 500 employees

- 3520977 Global Rank

- 1105184 United States

-

Direct49.63%

-

Search42.58%

-

Social7.79%

-

Display0.00%

-

Mail0.00%

-

Referrals0.00%

- 0 SDKs

- App Url: https://itunes.apple.com/app/preferred-home-mortgage/id1071886053

- App Support: http://www.phmc.com

- Genre: Finance

- Bundle ID: com.platinummortgage.sn

- App Size: 36.9 M

- Version: 19.3.100

- Release Date: January 5th, 2016

- Update Date: December 8th, 2017

Description:

Looking for a simple and accurate mortgage app?

Platinum Home Mortgage provides a simple and accurate mortgage app.

Platinum Home Mortgage allows you to perform complex mortgage calculations with a simple interface, and accurate results. Now you also have a document scanner at your disposal as well.

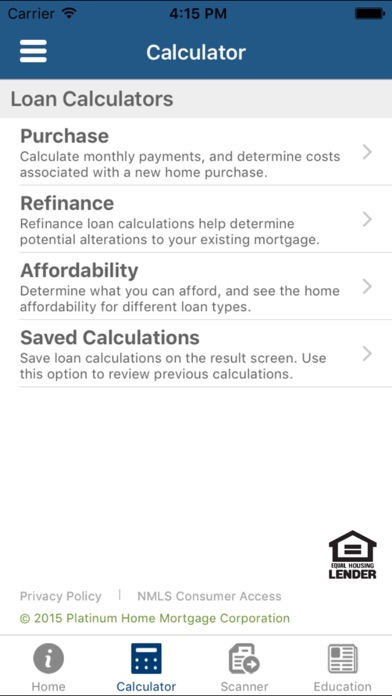

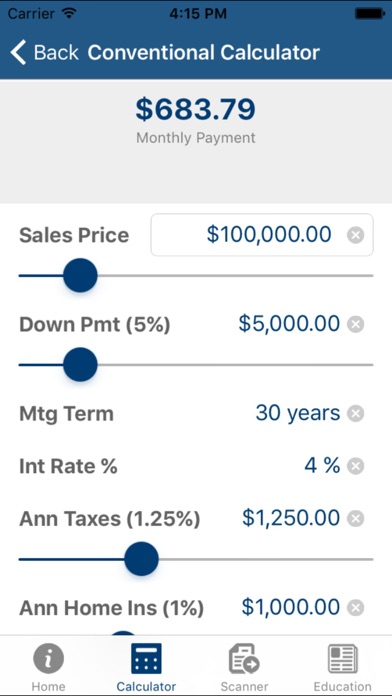

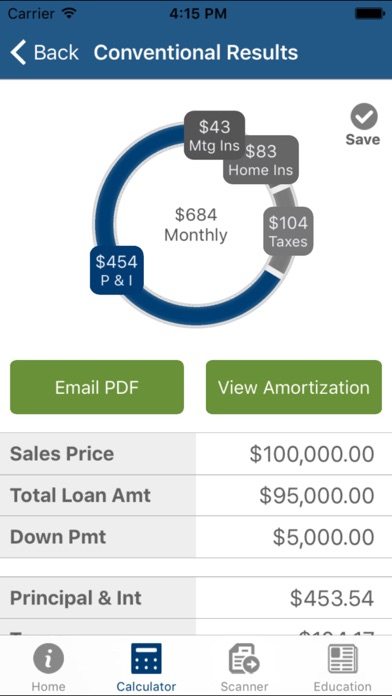

The calculator is quick and easy to use. Use the app to calculate New Home or Refinance FHA, Conventional, Jumbo, Rural, and VA loans. Affordability calculations can be done to determine what size of loan works for you. Enter a few parameters such as the sales price, insurance and tax amounts, and Platinum Home Mortgage will calculate your monthly payments. It handles all the details of calculating necessary MI and required down payment amounts by understanding the loan type you are looking to perform. When you are done with your mortgage loan calculation, save the quote for later or contact a qualified mortgage broker right from inside the app! Platinum Home Mortgage Calculator Features:

• 5 Loan Type Calculators: FHA, Conventional, Jumbo, Rural, and VA

• Calculate New Home or Refinance

• Accurate, yet Simple, Calculations Using Latest Regulations for MI

• Save Your Loan Quotes for later viewing

• Easy to Contact a Local Mortgage Broker

• The *ONLY* TILA Compliant Mortgage Calculator App with accurate APR displayed on every calculation.

The document scanner offers:

• Edge detection of pages

• Combines multiple pages into one pdf

• Emails the pdf using your email client

• Color, black and white, and grayscale scans.

• Make black and white images more crisp.

• Perspective adjustment to look like a real scan.

Even if you are a home owner looking for a new mortgage loan or a Realtor looking for an easy to use mortgage app, you'll love the Platinum Home Mortgage Calculator. Mortgage Brokers and Loan Officers love it because it's easy to offer their realtor associates and home buyers a branded, virtual business card - with mortgage calculations and document scanning.

Disclaimer: It is important to find the right home loan to match your budget. Use our calculator to figure out your total mortgage payment in advance by estimating your loan amount, interest rate and length of mortgage. Taxes and insurance amounts are not required, but are useful in determining your total payment amount. The results displayed are only estimates and cannot be used to determine actual loan costs or be used as a guarantee. Refinancing or taking out a home equity loan or line of credit may increase the total number of monthly payments and the total amount paid when comparing to your current situation.

-

Standard0%