Satin Creditcare Network Limited (SCNL) was formed in 1990 as a Non-Banking Finance Company (NBFC) with the simple concept of providing individual loans to urban shopkeepers for the working capital requirement of their tiny businesses. Since then the company has expanded and evolved into the sixth largest microfinance institution of India. The business model of the company revolves around dual bottom line approach by connecting financially excluded households to mainstream assured financial services in commercially sustainable manner.

SCNL has a mission to provide financial assistance to a large number of households which are excluded from the ambit of mainstream financial service providers so as to enhance their livelihood and promote a productive environment. With the vision to be a one stop solution for the financially excluded households at the bottom of the pyramid for all their financial requirements & a financial service power-house with a range of financial products designed and suited for the financially excluded community.

The company has been guided by extremely dynamic board with diversified experience in business, financial management, law and administration. SCNL follows the fair practice guideline as prescribed by the regulator (RBI) and the industry code of conduct by self regulatory organization (SRO) MFIN.

At present, SCNL has its strong presence and serves its clients throughout Bihar, Chandigarh, Delhi, Haryana, Jammu, Maharashtra, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh and Uttrakhand. The companyÍs microfinance operation is currently based on both Joint Liability Group (JLG) model as well Self Help Group model (SHG).

The company has been listed in Delhi, Jaipur and Ludhiana stock exchanges.

- Company Name:Satin Creditcare Network Limited

(View Trends)

-

Headquarters: (View Map)New Delhi, Delhi, India

-

Financial Services

-

> 10,000 employees

- 334012 Global Rank

- 18819 India

- 150 K Estimated Visits

-

Direct55.37%

-

Search32.65%

-

Mail9.53%

-

Social2.45%

-

Display0.00%

-

Referrals0.00%

-

100.00%

- 100 K Downloads

- 10 SDKs

- 2.06 Avg. Rating

- 1.04 K Total reviews

- App Url: https://play.google.com/store/apps/details?id=com.scnl.loanDost

- App Support: https://www.loandost.com

- Genre: finance

- Bundle ID: com.scnl.loanDost

- App Size: 55.4 M

- Release Date: November 12th, 2018

- Update Date: August 5th, 2020

Description:

Loan Dost provides online personal loan. Get a loan in 30 minutes, pay EMI on time and improve your CIBIL score*

Get started by downloading the app right away!

Loan Features:

● Repayment tenure from 4 months to 28 months

● Instant loan from Rs. 10,000/- to Rs. 1,50,000/-

● Annual rate of interest from 20% to 30% **

● Processing fee of 2% of loan amount on successful disbursal of loan

● Zero pre-closure charges

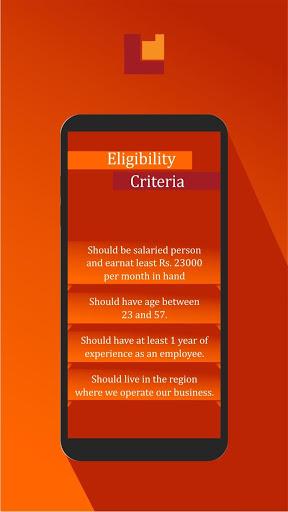

Eligibility:

● Minimum age of 21

● Monthly income more than Rs. 20,000/-

● For salaried, self-employed and free-lancer individuals

● Must be an Indian citizen

How to get loan:

● Completely paperless process - Apply for a personal loan through the app and pay back through the app

● No document pickup required for personal loan approval - completely app based

Sample Loan:

● Amount = Rs. 50,000/-

● Tenure (Months) = 24

● Annual Rate of interest = 20%

● EMI = Rs. 2545/-

● Processing Fee (Including GST) = Rs. 1,180/-

● Total Interest Payable = Rs. 11075/-

● Total Payment (Principal + Interest + Processing Fee) = Rs. 62,255/-

This app is brought to you by the Satin Creditcare Network Ltd (SCNL). SCNL has started its operations as a provider of individual and small business loans in 1990 with an objective to provide ‘doorstep’ credit in urban areas and gradually forayed into semi-urban and rural areas. SCNL was registered as an NBFC with the RBI in 1998 and converted into an NBFC-MFI in November, 2013. SCNL is trusted by the best banks and financial institutions in the country.

Visit www.loandost.com for more details.

RBI Disclaimer: The issuer Company is having a valid certificate of registration dated November 06, 2013 issued by the Reserve Bank of India under section 45 IA of the Reserve Bank of India Act, 1934. However, the RBI does not accept any responsibility or guarantee about the present position as to the financial soundness of the Issuer Company or for the correctness of any of the statements or representations made or opinion expressed by the issuer Company and for repayment of deposits/ discharge of liabilities by the Issuer Company.

* CIBIL score of customer depends primerly on repayment behaviour of customers at different institutions

**Rate of interest depends upon customer financial profile

Keywords: #loan, #online loan, #onlineloan, #personal loan, #mobile loan, #loan dost, #loandost

They are headquartered at New Delhi, Delhi, India, and have 1 advertising & marketing contacts listed on Kochava. Satin Creditcare Network Limited works with Advertising technology companies such as DoubleClick.Net, Network Solutions Ads.