TransferWise is the clever new alternative to banks and brokers, that allows people to transfer money abroad at a lower cost than ever before. It uses technology developed by the people who built Skype and PayPal to remove all the fees the foreign exchange industry has kept hidden for decades. Customers have already moved more than £1bn using the platform - an approach that has put over £45m back in their pockets.

How did TransferWise get started?

Estonian friends Taavet and Kristo came up with the idea for building the platform when they first became expats in London and were confronted by the high fees banks charge to transfer money abroad.

They used the official mid-market rate exchange rate (thatÍs the one in the papers, not the one invented by the bank). They both received the right amount of money, and neither paid any bank fees. Within a few months theyÍd saved thousands of pounds and realised there were probably millions of others that needed a system just like theirs. So they set to work - the rest is TransferWise.

- Company Name:Transferwise

(View Trends)

-

Headquarters: (View Map)London, United Kingdom

-

Internet

-

1,000 - 5,000 employees

- 878318 Global Rank

- 1427815 United States

- 289 K Estimated Visits

-

Direct57.43%

-

Search34.61%

-

Referrals4.10%

-

Mail3.85%

-

Display0.00%

-

Social0.00%

-

12.64%

-

8.48%

-

6.91%

-

6.17%

-

5.28%

- United States 20.3%

- Japan 13.4%

- Angola 6.3%

- Australia 5.6%

- Canada 4.8%

- Minor League

- Eastern League

- Bowie

- 10 SDKs

- 4.71 Avg. Rating

- 12.9 K Total reviews

- App Url: https://itunes.apple.com/app/transferwise/id612261027

- App Support: https://wise.com/help

- Genre: Finance

- Bundle ID: com.transferwise.Transferwise

- App Size: 97.1 M

- Version: 7.11

- Release Date: October 4th, 2013

- Update Date: June 1st, 2021

Description:

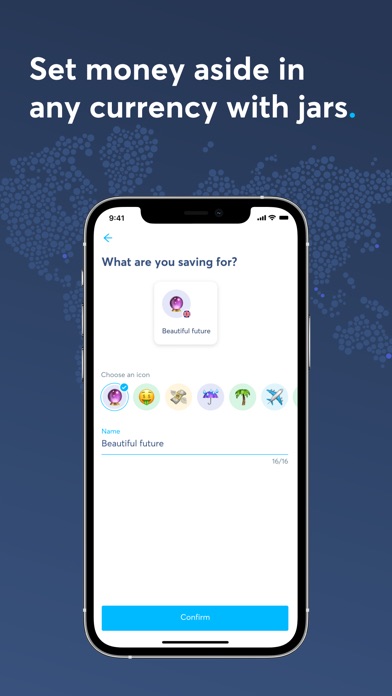

The international account

Join over 10 million people and businesses, in more than 170 countries, who use Wise to send, spend, convert, and receive money internationally.

Wise is for anyone — travelers, immigrants, freelancers, organisations — whose money crosses borders. We’re 8x cheaper on average than leading UK banks. And a lot faster, too.

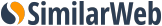

— Cheaper and faster money transfers —

• Send money to over 80 countries

• For a super-low fee, you get the real exchange rate, like on Google, for every money transfer

• 50% of transfers are instant or arrive within an hour

• Secure your transfers with two-factor authentication

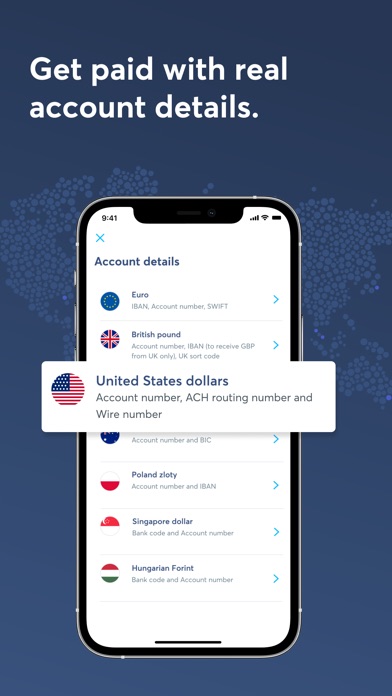

— A debit card to spend worldwide —

• Spend or withdraw money in more than 200 countries

• If you don’t have the local currency, we’ll auto-convert what you have with the lowest possible price

• Freeze and unfreeze your card, and update your virtual card whenever you like

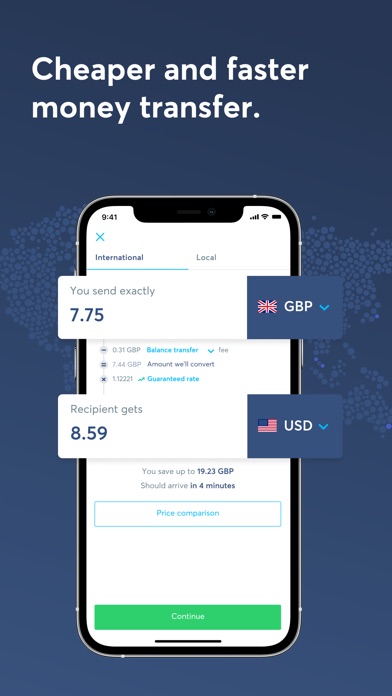

— Get paid with real account details —

• Get your own UK account number and sort code, European IBAN, US routing and account numbers, and more. As if you had local bank accounts around the world.

• Use these account details to get paid in multiple currencies for free, and for direct debits

• Keep up-to-date with instant push notifications for every transaction

— Hold 50+ currencies and convert between them instantly —

• No monthly fee and no maintenance fee to keep money in your account, in most cases

• Convert between currencies instantly, at the real exchange rate, for a super-low fee

— A better business account for going global —

• Pay invoices and bills faster, at a better exchange rate

• Use account details to get paid by clients and customers around the world

• Connect to supported platforms like Amazon, Stripe, Xero, and more

Wise is regulated by the FCA in the UK, and by other authorities around the world. Your money’s safe with us.

Send from: GBP (British Pound), EUR (Euro), USD (US Dollar), AUD (Australian Dollar), BGN (Bulgarian Lev), BRL (Brazilian Real), CAD (Canadian Dollar), CHF (Swiss Franc), CZK (Czech Koruna), DKK (Danish Krone), HKD (Hong Kong Dollar), HRK (Croatian Kuna), HUF (Hungarian Forint), JPY (Japanese Yen), NOK (Norwegian Krone), NZD (New Zealand Dollar), PLN (Polish Zloty), RON (New Romanian Leu), SEK (Swedish Krona), SGD (Singapore Dollar)

Send to: EUR (Euro), USD (US Dollar), GBP (British Pound), AED (UAE Dirham), AUD (Australian Dollar), BDT (Bangladeshi Taka), BGN (Bulgarian Lev), BRL (Brazilian Real), CAD (Canadian Dollar), CHF (Swiss Franc), CLP (Chilean Peso), CNY (Chinese Yuan), CZK (Czech Koruna), DKK (Danish Krone), EGP (Egyptian Pound), GEL (Georgian Lari), HKD (Hong Kong Dollar), HRK (Croatian Kuna), HUF (Hungarian Forint), IDR (Indonesian Rupiah), ILS (Israeli Shekel), INR (Indian Rupee), JPY (Japanese Yen), KES (Kenyan Shilling), KRW (South Korean Won), LKR (Sri Lankan Rupee), MAD (Moroccan Dirham), MXN (Mexican Peso), MYR (Malaysian Ringgit), NOK (Norwegian Krone), NZD (New Zealand Dollar), PEN (Peruvian Nuevo Sol), PHP (Philippine Peso), PKR (Pakistan Rupee), PLN (Polish Zloty), RON (Romanian Leu), RUB (Russian Rouble), SEK (Swedish Krona), SGD (Singapore Dollar), THB (Thai Baht), TRY (Turkish Lira), UAH (Ukrainian Hryvnia), VND (Vietnamese Dong), ZAR (South African Rand)

Sort by

Gorkipark

lachito1982

Malísima aplicación

JuviedeG

Last ACH transfer was a mess.

Wensum

Terrible now

flexi06

Brilliant

aliii421

Envío de dinero

-

Native6.12%

-

Standard93.88%

-

Direct0.00%

They are headquartered at London, United Kingdom, and have 9 advertising & marketing contacts listed on Kochava. Transferwise works with Advertising technology companies such as Google Remarketing, Rocket Fuel, AppNexus, AdRoll, Google Adsense, The Trade Desk, AppNexus Segment Pixel, Index Exchange, Advertising.com, Bizo, Turn, Facebook Exchange FBX, Facebook Custom Audiences, Twitter Ads, Openads/OpenX, Yahoo Small Business, IponWeb BidSwitch, BounceX, LinkedIn Ads, Rubicon Project, DoubleClick Bid Manager, Pubmatic, Atlas, DoubleClick.Net, Podsights, Snap Pixel, Microsoft Advertising, Impact.

Questionable service