We work hard every day to help over 7 million Americans save for a college education, healthcare, and retire successfully. This is both our passion and expertise. Through partnerships with financial institutions and financial professionals, our savings plans are designed to be smart, clear, personal, and most of all, effective.

We are the largest independent retirement and college savings services provider in the United States, supporting approximately 50,000 retirement plans, 4 million 529 college savings accounts, and administering more than 1.5 million IRAs and health savings accounts.

When you choose Ascensus as a partner or a service provider, rest assured, you will always have a plan. For more information, visit ascensus.com.

- Company Name:Ascensus

(View Trends)

-

Headquarters: (View Map)Dresher, PA, United States

-

Financial Services

-

1,000 - 5,000 employees

- 97798 Global Rank

- 17883 United States

- 419 K Estimated Visits

-

Direct69.08%

-

Search20.08%

-

Referrals9.72%

-

Mail0.61%

-

Social0.50%

-

Display0.00%

-

98.66%

-

0.22%

-

0.12%

-

0.11%

- 10 SDKs

- App Url: https://itunes.apple.com/app/ascensus/id1455711985

- App Support: https://www.calsavers.com/home/contact-us.html

- Genre: Finance

- Bundle ID: com.ascensus.calsavers

- App Size: 29.8 M

- Version: 1.7.11

- Release Date: June 29th, 2019

- Update Date: January 16th, 2021

Description:

There’s an answer for 7.5+ million Californians without access to a workplace retirement plan. CalSavers is a low-cost, automatic savings vehicle with professionally managed investments. Get a simple, trusted way to save.

Use the mobile app to do the following:

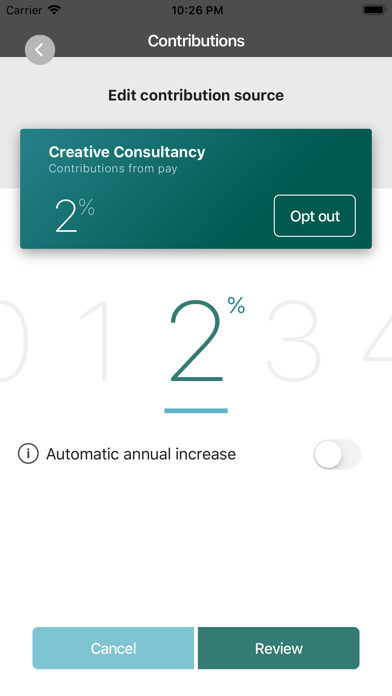

• Change your savings rate

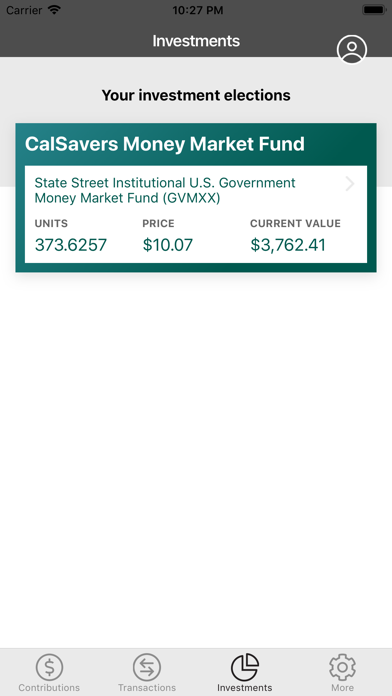

• Check your balance

• View transaction history

• Add personal contributions

Visit www.calsavers.com to learn more about the program.

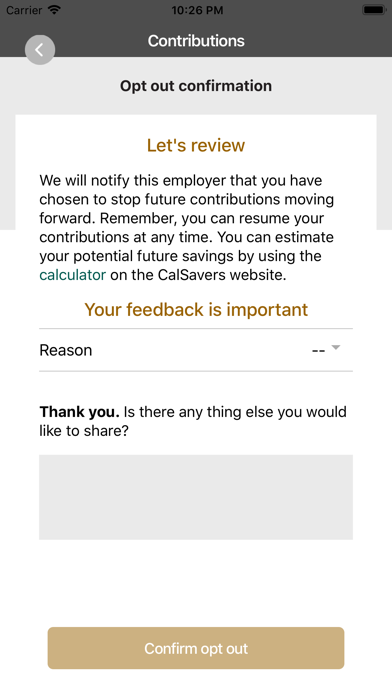

Images are for illustrative purposes only.

iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries.

The CalSavers Retirement Savings Program ("CalSavers" or the "Program") is an automatic enrollment payroll deduction IRA overseen by the California Secure Choice Retirement Savings Investment Board ("Board"). Ascensus College Savings Recordkeeping Services, LLC ("ACSR") is the program administrator. ACSR and its affiliates are responsible for day-to-day program operations. Participants saving through CalSavers beneficially own and have control over their IRAs, as provided in the Program Disclosure Booklet available at saver.calsavers.com. CalSavers is not sponsored by the employer, and therefore the employer is not responsible for the Program or liable as a Program sponsor. Employers are not permitted to endorse the Program or encourage or advise employees on whether to participate, how much (if any) to contribute or provide investment help.

CalSavers offers investment options selected by the Board. For more information on CalSavers’ investment options go to saver.calsavers.com. Account balances in CalSavers will vary with market conditions. Investments in CalSavers are not guaranteed or insured by the Board, the State of California, the Federal Deposit Insurance Corporation, or any other organization.

CalSavers is a completely voluntary retirement program. Savers may opt out at any time or reduce or increase the amount of payroll contributions. If a saver opts out they can later opt back into CalSavers. In addition, California law requires that CalSavers conduct an Open Enrollment Period once every two years during which eligible employees that previously opted out of the Program shall be re-invited to participate under automatic enrollment and must opt out again if they still do not wish to participate in the Program.

Saving through an IRA may not be appropriate for all individuals. Employer facilitation of CalSavers should not be considered an endorsement or recommendation by a participating employer, IRAs, or the investment options offered through CalSavers. IRAs are not exclusive to CalSavers and can be obtained outside of the Program and contributed to outside of payroll deduction. Contributing to a CalSavers IRA through payroll deduction may offer some tax benefits and consequences. However, not everyone is eligible to contribute to a Roth IRA and savers should consult a tax or financial advisor if they have questions related to taxes or investments. Employers do not provide financial advice and employees should not contact an employer for financial advice. Employers should refer all questions about the Program to CalSavers. Employers are not liable for decisions employees make pursuant to Section 100034 of the California Government Code.

They are headquartered at Dresher, PA, United States, and have 7 advertising & marketing contacts listed on Kochava. Ascensus works with Advertising technology companies such as DoubleClick.Net, Google Remarketing, Twitter Ads, LinkedIn Ads.