As AustraliaÍs _rst 100% customer owned bank we see the business of banking a little differently to our competitors _ and chances are if youÍre reading this you do too.

Being sharp on price, and making a pro_t is important to us all. But we believe money should also be put to good use, creating positive social, environmental and cultural outcomes. A kind of mutual prosperity for all.

Not being bound by the demands of external investors means we act in the best long term interests of our customers. Put simply, as a customer and part owner of the bank, weÍre answerable only to them.

Customers have been banking with us since 1957 and today nearly 130,000 people and community sector organisations choose to bank with us.

Our profits are reinvested in the bank to provide fairer fees, better interest rates, and the responsible products and services that our customers expect.

Bank Australia has 24 branches across Melbourne and regional Victoria, Brisbane, Gold Coast, Townsville, Adelaide and Sydney. Our contact and lending centres are based in regional Victoria.

- Company Name:Bank Australia

(View Trends)

-

Headquarters: (View Map)Melbourne, Victoria, Australia

-

Banking

-

200 - 500 employees

- 62900 Global Rank

- 1069

- 921 K Estimated Visits

-

Direct70.15%

-

Search24.77%

-

Mail3.09%

-

Social1.17%

-

Referrals0.79%

-

Display0.04%

-

0.45%

-

0.26%

-

0.25%

-

0.17%

- Australia 98.4%

- Opportunities

- Partners Programs

- Amazon Associates Program

- 10 SDKs

- 4.55 Avg. Rating

- 69 Total reviews

- App Url: https://itunes.apple.com/app/bankmecu/id993512650

- App Support: https://bankaust.com.au/tools/banking-apps/

- Genre: Finance

- Bundle ID: au.com.bankmecu.bancapp01

- App Size: 135 M

- Version: 3.1.2

- Release Date: June 10th, 2015

- Update Date: April 27th, 2021

Description:

Our app provides you with a secure and easy way to bank on the go. To get started just login using your customer number and internet banking password

What is included in the Bank Australia app?

Everyday banking

• Share your account details with the tap of a finger

• Set up and manage Round UP. Have your card purchases round up to the nearest dollar, with the additional amount transferred to your nominated account.

• Provide your Tax File Number or Foreign Tax Residency information

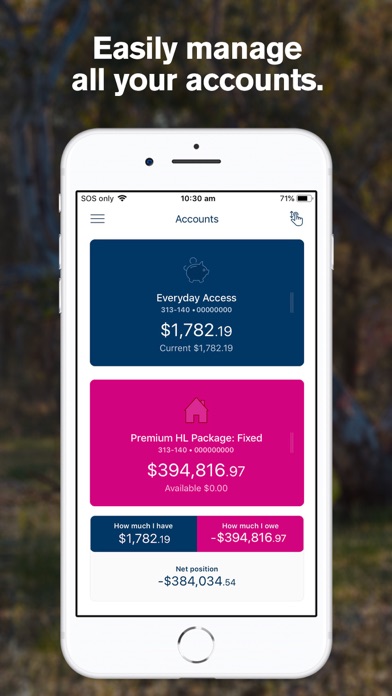

• View how much money you have, how much you owe, and your net position across all accounts

• Use 3D touch to access shortcuts to transfer, pay someone, manage cards or view accounts

• Download up to 12-months of your transaction history

• Add a quick balance widget to your phone or Apple Watch so you can check your account balance without log in. Once setup, you can ask Siri for an account balance update

• Track spending via categories in your Spend Tracker

• Customise the length of time before you’re auto-logged out of the app

• View your session history

• App details – view important information about your app and device

• Travel notifications – let us know when you’re heading overseas so we can keep an eye out for when something’s not right

• View and manage eStatements

• Create alerts based on your credit/debit card activity

• Receive alerts when your loan is due or overdue, and when your account is overdrawn

• View product pages within the app

• Set up account alerts for payments or balance thresholds

• Access calculators to help you better manage your finances

• Locate and get directions to your nearest branch

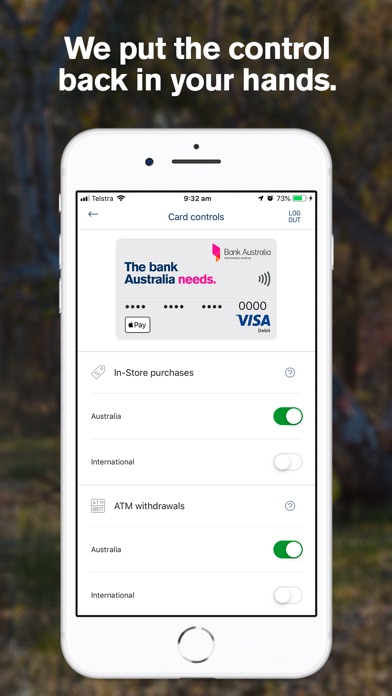

Card management

• Digital cards - your Visa debit/credit card information is now securely available in Cards You can now cancel and reorder cards from within the app. When you do this, you will get an instant digital version of your card. Add it to Apple Pay and start spending straight away. No need to wait for your physical card to arrive

• Card Controls – manage your credit/debit card features, such as payWave, reduce your credit card limit or cancel your credit card, lock your card temporarily

• Report a lost or stolen card, activate a card or change your card’s PIN

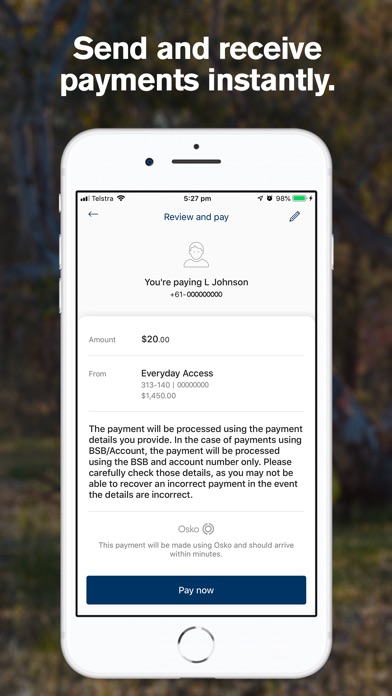

Payments

• Look Who’s Charging – a quick and easy way to see who has charged your card

• Check your balance and get a quick balance

• Transfer funds, including fast payments with Osko

• Manage and edit all your payees in one place via ‘Manage Payees’

• Add new payees

• Create and maintain your PayID

• Transfer funds

• Pay your bills

• Make international transfers

A few things to remember

• Don’t keep your customer number and PIN with your mobile device

• Make sure you log out when you’re done

• The app will automatically log out after five minutes of no activity

• Get in touch with Bank Australia immediately if you’ve lost your mobile device or feel that someone may know your login details

• You must be registered for internet banking to have access to the app

NOTE: mobile data usage charges may apply, check with your mobile service provider for details.

We collect anonymous information on how you use the application to perform statistical analysis of aggregate user behaviour. By installing this app, you are giving your consent. We do not collect personal information about you.

Sort by

Meikoh

Kyle267

Dodgy Update

Gagsangel

New interface is horrible

T dawg g unit

Not sure why I have to re-register

it'scoolnowpeople

Reinstall app to resolve access issues

Bugnacious

Error - Access denied

-

Native0.00%

-

Standard57.69%

-

Direct42.31%

They are headquartered at Melbourne, Victoria, Australia, and have 2 advertising & marketing contacts listed on Kochava. Bank Australia works with Advertising technology companies such as DoubleClick.Net, Tribal Fusion, AppNexus, Facebook Custom Audiences, Google Remarketing, Twitter Ads, Google Floodlight Counter, Google Floodlight Sales, LinkedIn Ads, DoubleClick Bid Manager, Microsoft Advertising, Scenestealer, Flashtalking, The Trade Desk, Rubicon Project.

Very happy with the app