Who we are

WeÍre a fintech company thatÍs building an exceptional team of high performing, yet humble individuals who believe Canadians deserve more choice when it comes to financial services.

Put simply, weÍre a fintech thatÍs putting people first. A key goal for us is to achieve gender parity and a culturally diverse team. Currently, 40% of our team is made up of women and 32% were born outside of Canada. 28% of our team is aged 25 or younger and 24% is 40 or older.

WeÍre always on the lookout for passionate and driven people. If you think youÍd be a great fit at Borrowell, read on to learn more about us and how our business works!

What we do

We help Canadians make great decisions about credit. We were the first company in Canada to offer Equifax credit scores and reports for free, without applying for credit, and we currently have over 350,000 users.

We recommend financial products such as personal loans, credit cards and mortgages based on our clientÍs unique financial profile. We also offer educational tips and tools to help improve their credit score.

We also created the ñBorrowell Loanî _ an affordable, fixed-rate personal loan. The wholly online application instantly provides personal loan quotes to Canadians with good credit as an alternative to expensive credit card debt.

We also have a ground-breaking partnership with CIBC, one of North AmericaÍs largest banks, to offer 'one-click'_ loans and credit scores to their customers. We're backed by investors including White Star Capital, Portag3 Ventures, and Equitable Bank.

Borrowell has received significant recognition, including being named one of eleven Canadian ñCompanies-to-Watchî by the Deloitte Technology Fast50 program, and as one of the worldÍs top fintech companies by the KPMG Fintech 100 list.

If this sounds like a place youÍd love to work, check out our careers page at www.borrowell.com/careers to apply.

- Company Name:Borrowell

(View Trends)

-

Headquarters: (View Map)Toronto, Ontario, Canada

-

Financial Services

-

10 - 50 employees

- 29046 Global Rank

- 715 Canada

- 1.94 M Estimated Visits

-

Direct70.13%

-

Search18.52%

-

Mail8.76%

-

Referrals1.46%

-

Social1.09%

-

Display0.03%

-

95.91%

-

2.47%

-

0.20%

-

0.17%

-

0.17%

- Canada 90.9%

- Mexico 5.3%

- United States 3.0%

- Builders and Contractors

- 0 SDKs

- 4.81 Avg. Rating

- 200 Total reviews

- App Url: https://itunes.apple.com/app/borrowell/id1445507308

- App Support: https://borrowell.com/contact-us

- Genre: Finance

- Bundle ID: com.borrowell.strangelove

- App Size: 63.2 M

- Version: 6.1.0

- Release Date: April 17th, 2019

- Update Date: June 16th, 2021

Description:

Borrowell is dedicated to making financial stability possible for everyone. In three minutes or less, get your Equifax credit score and report for free in our app.

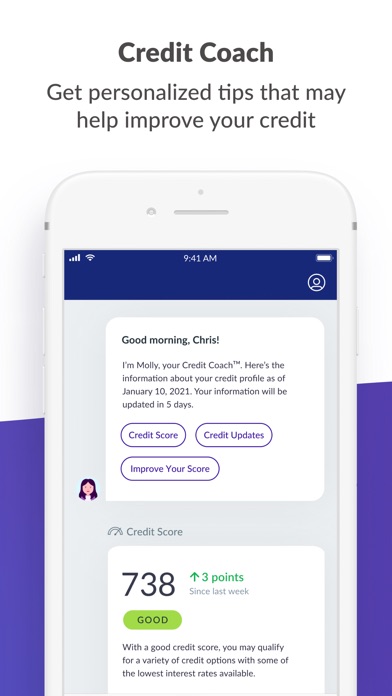

Molly, Canada’s first AI-powered Credit Coach, will explain your credit score and give you great tips and product recommendations like credit cards, personal loans, and mortgages.

You can also track your upcoming bills, income and forecasted balance. Stay organized and never miss a bill payment.

Features You’ll Enjoy:

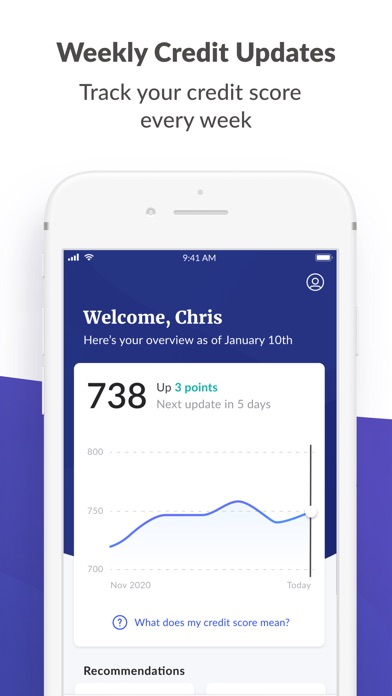

►FREE CREDIT MONITORING◄

Borrowell has provided more than one million Canadians with free access to their credit information. When you download the app, we'll refresh your credit score each week for free and you can track your weekly progress on your credit dashboard.

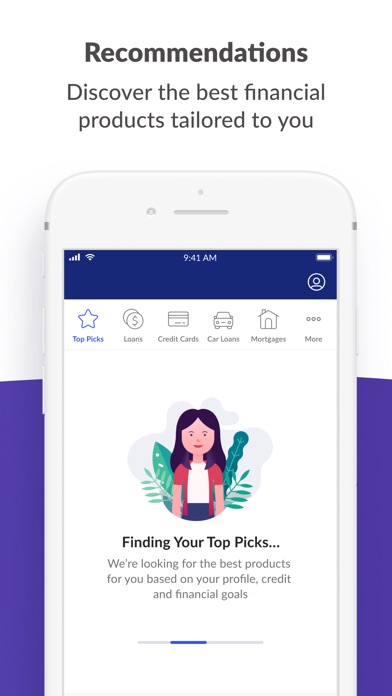

►PERSONALIZED PRODUCT RECOMMENDATIONS◄

Borrowell offers a platform with hundreds of financial products. Get access to personalized financial product recommendations, like loans, credit cards, bank accounts, insurance, and the best mortgage rates to improve your financial well-being.

►TRACK BILLS AND PREDICT BALANCE◄

Exclusively available on the Borrowell App, Borrowell predicts your upcoming bills, forecasts your future balance and alerts you when it’s low.

►MOLLY: THE BORROWELL CREDIT COACH◄

Ever wondered what makes up your credit score and how to improve it? Molly, The Borrowell Credit Coach is Canada's first AI-powered tool that helps you better understand your credit score and gives you tips to improve it.

►EASY ONLINE LOAN PROCESS◄

When you get your free credit score, we'll show you the best loan options that are suited to your financial profile from our trusted partners. Browse personal loans, business loans, and car loans. In some cases, you can apply online and get money deposited into your bank account as soon as the next business day. Loans are simple with Borrowell!

►SEE THE BEST MORTGAGE RATES◄

Borrowell works with trusted mortgage partners to make the mortgage process simple. Whether you’re buying, renewing, or refinancing, we make finding the perfect mortgage easy. See your mortgage options with the top mortgage rates in Canada – all in one place!

Why You’ll Love The Borrowell App:

►EVERYTHING IN ONE PLACE◄

Get the full picture when it comes to your financial health. The Borrowell app allows you to see your credit score and report, personalized product recommendations, upcoming bills, and predicted cash flow all in one place. At a glance, you can check in on your current financial well-being.

►SAFE AND SECURE◄

At Borrowell, protecting our members' information is our top priority and we use the highest level 256 bit AES encryption available to actively keep your information safe.

Why Do 1 Million Canadians Trust Borrowell?

"Competitive and transparent rates on loans" - The Globe And Mail

"Fintech company wants to save consumers a lot of money on credit cards" - The Financial Post

"Before you go to bed tonight, you have to find out your credit score" - Breakfast Television

Borrowell has also received multiple awards:

-FinTech Company of the Year - Canadian SME National Business Awards, 2019

-Breakout Finance App - AltFi, 2019

-Platinum Nominee - Best Mobile App Awards, 2019

-FinTech Startup Of the Year - FinTech & AI Awards, 2018

-Innovative Lender of The Year - Canadian Lenders Association, 2017

-Fintech 100, KPMG, 2017

-“Company-to-Watch”, Deloitte Technology Fast50 program, 2017

-PWC Vision To Reality Finalist, 2017

-Best Places to Work™ for Women, Millennials, and Financial Services and Insurance

When you download and use the Borrowell app, you agree to Borrowell's Terms of Use. https://www.borrowell.com/terms

The Borrowell app is great for keeping up on the go, but you can still access the web version at Borrowell.com. Bill Tracking is exclusively available on the Borrowell App.

Sort by

caall1

Samy djerad

Chicken

John Greggerson

Very pleased

ccpuppydog

Ccpuppydog

Rip off n waste of $

Great way to keep track of your credit score

jmsrookie

Borrowell

-

Native2.86%

-

Standard96.33%

-

Direct0.82%

They are headquartered at Toronto, Ontario, Canada, and have 1 advertising & marketing contacts listed on Kochava. Borrowell works with Advertising technology companies such as DoubleClick.Net, AdRoll, AppNexus, AppNexus Segment Pixel, Bizo, Facebook Custom Audiences, LinkedIn Ads, Twitter Ads, Facebook Exchange FBX, Openads/OpenX, Yahoo Small Business, IponWeb BidSwitch, StackAdapt, Google Remarketing, Rubicon Project, Advertising.com, SpotXchange, Pubmatic, StickyAds TV, Index Exchange, Taboola, Atlas, The Trade Desk, Adobe Audience Manager Sync, DemDex, DoubleClick Bid Manager, Google Adsense, Google Adsense Asynchronous, Google AdSense Integrator, Impact, Snap Pixel, Tapad, ExactTarget, Microsoft Advertising, StackAdapt Retageting.

Simple and exceptional