Founded by a CPA and U.S. Tax Court Practitioner, GetPayroll is the last word in fully assisted, digital payroll and payroll tax services for businesses of all sizes.

Since 1991 we have created affordable, all-inclusive payroll solutions for our clients. GetPayroll offers risk-free, stress-free, all-inclusive payroll, payroll tax services and employment tax compliance at an easy, cost-competitive, flat monthly rate, as well as business and payroll tip and tricks to help business owners run their businesses more smoothly.

Recently, we launched the first payroll smartphone app available in the United States for micro business owners with up to 10 employees at SXSW17 in Austin, Texas, and received a multitude of media exposure. The very first Green and totally paperless payroll itÍs free until you use it. As a result of media exposure, we are growing very quickly.

With @getpayroll & SIMON #3click #paperless #payroll on your #smartphone #smallbiz and #millennials #microbusiness doesn't have to suck!

- Company Name:Getpayroll & Simon

(View Trends)

-

Headquarters: (View Map)Lewisville, TX, United States

-

Financial Services

-

10 - 50 employees

- 16664444 Global Rank

- 4132165 United States

-

Direct53.53%

-

Search46.47%

-

Display0.00%

-

Mail0.00%

-

Referrals0.00%

-

Social0.00%

- 0 SDKs

- App Url: https://itunes.apple.com/app/get-payroll/id1243280498

- App Support: http://www.getpayroll.com/contact-getpayroll/

- Genre: Business

- Bundle ID: com.getpayroll.simon2

- App Size: 20.3 M

- Version: 1.01

- Release Date: July 17th, 2017

- Update Date: July 17th, 2017

Description:

As easy as 1-2-3 for small businesses with 1 to 10 employees. Stop paying ADP and Paychex prices! We include everything: W2s/1099s, payroll taxes, and quarterly report filings-automatically. 100% Affordable. 100% guaranteed.

The Problem Payroll We Are Solving With Simon

Micro-businesses are overcharged (forced to buy services they’ll never use at their size) and underserved by payroll providers leaving them to figure it out, on their own. Resulting in payroll errors and costly IRS penalties.

Our Solution

We set out with a single focus: to provide a service that micro-business owners will love. How?

-It’s easy to use.

-It takes away the worry about doing payroll wrong and getting fined by the IRS or the State.

-It helps the businesses owner keep track of when payroll is due.

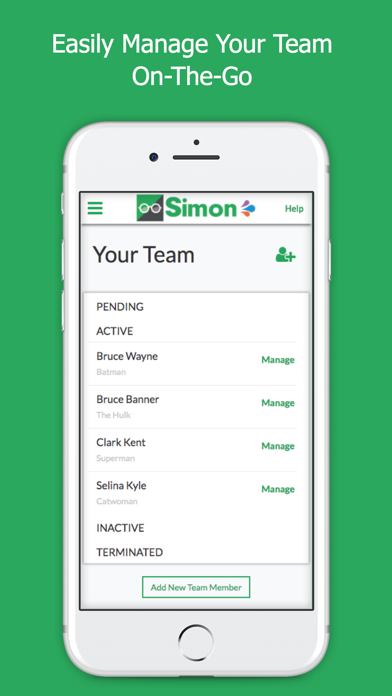

-It makes it easy to register and on board employees.

-It eliminates paperwork with technology.

Simon Highlights

-Designed exclusively for micro-businesses with up to 10 employees.

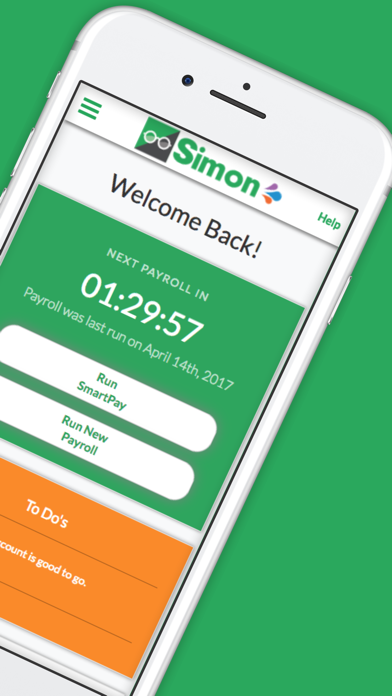

-SmartPay technology. Run payroll in 3-clicks for repeat payrolls.

-Edit last payroll and run it in as little as 6-10 clicks.

-The first true GREEN payroll.

-Employer self registration in minutes.

-100% employee self onboard including W-4 and I-9. Employer receives alert when employee completes onboarding. All completed forms stored in cloud.

-Dashboard home screen with all key features needed to manage payroll.

-Live countdown ticker with automated text message alerts 48 hours, 24 hours, 8 hours, 4 hours, and 30 minutes before payroll is due to help keep payroll on time. Ticker changes color from green to orange to red as you get closer to your due date/time.

-Get alerts with payroll to-do's.

-Pay payroll taxes, and federal, state, unemployment taxes automatically.

-All tax filings, federal, state and local are made automatically, with copies sent to you.

-Pay through direct deposit or debit card.

-Next payroll automatically setup to run.

-Link payroll runs to auto send report to accountant.

-Lifetime employee portal to view forms and check stubs.

-Manage all employee data. Customize each employee’s payroll earnings and deductions.

-View payroll history and run custom reports. Email or download into iBooks.

-Update and edit company information.

Calculate and record manual checks.

FAQ section with video tutorials.

Refer a friend and earn free payrolls.

Our Guarantee

Never miss a payroll. Never miss a payroll tax filing or payment. No more errors on your payroll tax forms. If anything happens as a result of our processing, we will take care of anything that has to do with employment tax authorities including the IRS from start to finish, 100%. Our CEO is a U.S. Tax Court Practitioner and has the authority to advocate for you in all levels of the IRS up to, and including, U.S. Tax Court.

About GetPayroll

We are a successful payroll service bureau with a 26-year history and a national footprint. Learn more about us on our website at www.getpayroll.com.