IMB Bank boasts a 135 year history offering highly competitive banking and financial products and services to our members through its wide network of branch locations, mobile banking and Contact Centre facilities.

Employing in excess of 500 staff, our values describe the essence of what we represent to all our stakeholders including our staff - Respect, Integrity, Performance, Member Focus & Offering Solutions.

IMB's products extend to home and personal loans; savings, transaction and investment accounts; credit and debit cards, insurances and also travel products through our alliance partners.

A team of dedicated IMB Business Banking Managers service SME's with a range of financial products for businesses including lending, cash management deposit products, merchant and payroll facilities, as well as asset and debtor finance.

IMBÍs Treasury Department provides investor solutions to Local Government, State Statutory Bodies, Commonwealth Government Agencies, Private and Public Corporations and Institutions, Clubs and Not-for-profit Organisations.

A financial planning service is on offer from IMB Financial Planning Limited, with a team of experienced and qualified financial planners developing and monitoring financial plans for members located across the Sydney and Illawarra regions down to the Victorian border.

- Company Name:Imb Ltd

(View Trends)

-

Headquarters: (View Map)Wollongong, New South Wales, Australia

-

Banking

-

500 - 1,000 employees

- 152393 Global Rank

- 2888

- 230 K Estimated Visits

-

Direct72.16%

-

Search24.56%

-

Mail1.22%

-

Display1.02%

-

Social0.65%

-

Referrals0.40%

-

0.90%

-

0.54%

-

0.33%

-

0.33%

- Australia 93.5%

- Banking Services

- Banks and Institutions

- 10 SDKs

- 2.51 Avg. Rating

- 50 Total reviews

- App Url: https://itunes.apple.com/app/imb-bank/id456594865

- App Support: http://www.imb.com.au

- Genre: Finance

- Bundle ID: com.imb.banking2

- App Size: 59.9 M

- Version: 3.9.8

- Release Date: September 12th, 2011

- Update Date: March 10th, 2021

Description:

The IMB Mobile Banking App lets you do your banking on your mobile when and where it suits you. With all the functionality you need day to day and all of the security you would expect from Internet Banking, banking on your mobile device just got better.

The IMB Mobile Banking App will register your mobile device for added security, and allow you quick and easy sign on with Touch ID or a secure 4-digit PIN

With the IMB Mobile Banking App you can:

• Sign on with your fingerprint (on devices with Touch ID)

• Tap to check up to 3 account balances without logging in with Balance Peek

• View up to 12 months’ transaction history

• Switch between your personal and business accounts

• Transfer money to your payees

• Set up a new payee and delete an existing payee

• Transfer money between your IMB accounts

• Pay billers using BPAY®

• Set up a new biller and delete an existing biller

• Schedule one-off transfers

• View and delete pending payments

• Share payment receipts via Email, SMS and Facebook

• Customise your accounts using images from our library

• View your accounts in grid or list format

• Find your nearest Branch or ATM

• View current interest rates

To register your device for the IMB Mobile Banking App, you’ll need to be registered for Internet Banking and SMS 2 Factor Authentication (2FA).

IMB Members not registered for Internet Banking and SMS 2FA should visit imb.com.au or call us on 1300 123 164. First time Internet Banking users will need to log on to Internet Banking at least once before using the app.

When first registering for the Mobile Banking App, you will be asked to provide your usual Internet Banking login details. You will then be sent a one-time security code to your registered mobile number via SMS. You will need to enter this code to set up your secure 4-digit App PIN. Once your 4-digit App PIN is set up, this is all you will need to log in to the Mobile Banking App. Your App PIN can be changed at any time from within the Mobile Banking App.

Established in 1880, IMB Bank has been helping people achieve their financial goals for over 135 years. We do this by offering competitive products, practical solutions and superior customer service.

For Terms and Conditions of use for the Mobile Banking App please refer to IMB’s website. Normal data charges apply. Check with your phone provider for details. Consider the PDS, available from IMB, before making a decision about this product. IMB Ltd trading as IMB Bank | ABN 92 087 651 974 | AFSL 237 391.

What’s New

- Osko by BPAY™ - Osko is an innovative payment service which allows Australians to make and receive faster payments to each other via any participating bank.

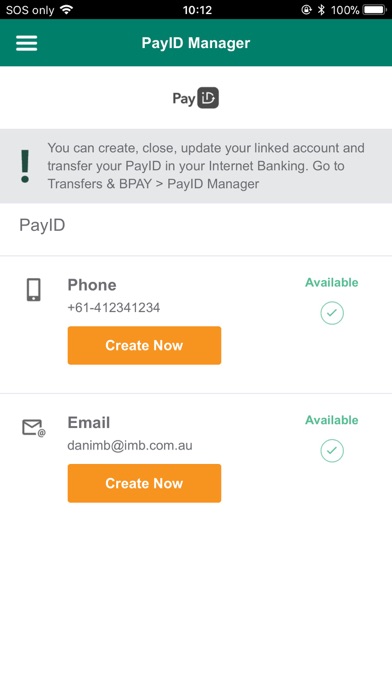

- PayID is an addressing service for payments that replaces the need to provide your sensitive financial account details, such as BSB and account number. A PayID can be set up using a Mobile Number or Email Address.

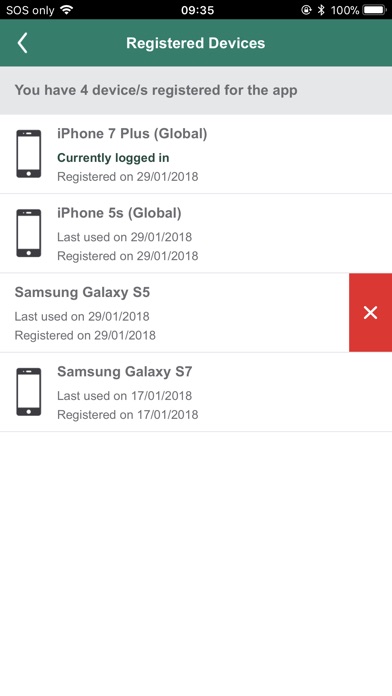

- Registered Device Management – View and manage mobile app registered devices.

Sort by

erinal

SHA63R 355

App broken

Jules284

Can't download

Yummie69

Won't open

Sam1727383845959

THANK YOU

Liliania52

Useless now

-

Native0%

-

Standard0%

-

Direct0%

They are headquartered at Wollongong, New South Wales, Australia, and have 3 advertising & marketing contacts listed on Kochava. Imb Ltd works with Advertising technology companies such as Brandscreen, DoubleClick.Net, AdRoll, Zenovia, AppNexus, AppNexus Segment Pixel, Google AdSense Custom Search Ads, Google Adsense, Tribal Fusion, Google Consumer Surveys, Facebook Custom Audiences, Flashtalking, Google Remarketing, Openads/OpenX, Yahoo Small Business, Geniee, Pubmatic, Rubicon Project, Rocket Fuel, BlueKai DMP, SpotXchange, Index Exchange, Taboola, Tapad, BlueKai, IponWeb BidSwitch, Adobe Audience Manager Sync, X Plus One, Advertising.com, DemDex, DoubleClick Bid Manager, LinkedIn Ads, Bizo, Media.net, Media Innovation Group, Outbrain, Drawbridge, eXelate, Eyeota, The Trade Desk, IntentIQ.

This is sort of a nuisance