AustraliaÍs No. 1 mortgage franchise

Smartline was established in 1999 with the simple goal of building AustraliaÍs best mortgage broking business and putting people, rather than banks, in control of their loan options.

We provide a wealth of support to help our franchisees succeed and deliver a level of service that clients love, return for and tell their friends about. Over the past decade, franchisees across Australia have voted Smartline:

´ No. 1 rated Australian mortgage broking franchise nine years in a row.

´ AustraliaÍs top franchise business* in all industries eight years in a row.

* Comprehensive topfranchise.com.au survey of over 1000 franchisees from across the country.

Applauded by clients and awarded by industry

Since opening our doors, Smartline has become one of AustraliaÍs most respected mortgage broking groups amongst Australian property buyers, business owners, and our industry peers:

´ Over 275,000 Australians have arranged mortgages with us.

´ We have 300+ expert Advisers around the country.

´ We settle $6 billion in loans each year.

´ 85% of our business comes from delighted client referrals.

´ Our average client service rating is 4.9 out of 5.

´ WeÍve been recognised with multiple national awards.

(Australian Credit Licence Number 385325)

- Company Name:Smartline Personal Mortgage Advisers

(View Trends)

-

Headquarters: (View Map)North Ryde, New South Wales, Australia

-

Financial Services

- 679435 Global Rank

- 19272

- 74.1 K Estimated Visits

-

Search33.69%

-

Social30.38%

-

Direct20.64%

-

Mail12.34%

-

Referrals2.94%

-

Display0.00%

-

1.55%

-

1.32%

-

1.07%

-

0.75%

- 10 SDKs

- 3.14 Avg. Rating

- 3 Total reviews

- App Url: https://itunes.apple.com/app/smartline-personal-mortgage-advisers/id387340097

- App Support: http://www.smartline.com.au

- Genre: Finance

- Bundle ID: com.neosofttech.LoanCalculator

- App Size: 1.29 M

- Version: 2.6

- Release Date: August 24th, 2010

- Update Date: December 2nd, 2016

Description:

Smartline's Free Loan Calculator makes it easy to work out your loan repayments.

Simply enter your loan amount, interest rate and term, and see your loan repayments weekly, fortnightly or monthly.

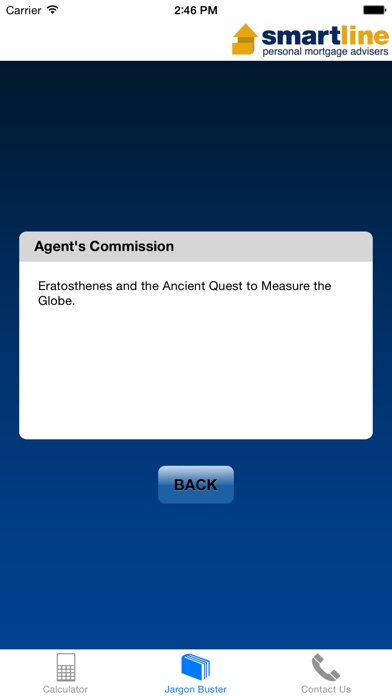

It will also show you how much interest you're paying plus there's a a handy "jargon buster".

To get help sorting out your mortgage, contact Smartline for your own Personal Mortgage Adviser.

About Smartline Personal Mortgage Advisers

Established in 1999, Smartline is an Australian-owned mortgage broker with over 200 Advisers throughout Australia.

All Smartline Mortgage Advisers are fully qualified and trained mortgage broking professionals.

They’ve joined Smartline because they are people who are motivated by getting great outcomes for their clients, every time. Stringent standards ensure that the loan application is hassle free. It works.

Smartline is the winner of numerous industry awards for best mortgage broking group and was recently ranked number one franchise in Australia. But being judged positively by our peers is one thing. It is the "vote" of our clients that counts most. We are proud to have helped more than 100,000 Australians arrange their home finance.

Over 85% of our loans come from a personal recommendation. Our clients rate our service an average of 9.6 out of a possible 10.

As a contribution to our community, we donate $10 to charity for every home loan we complete.

Sort by

Jamesiewaimsy

ErinLambeck

Like the Jargon Buster!

ChrisKateFinnErica

Homeloan

-

Native0.00%

-

Standard99.34%

-

Direct0.66%

They are headquartered at North Ryde, New South Wales, Australia, and have 2 advertising & marketing contacts listed on Kochava. Smartline Personal Mortgage Advisers works with Advertising technology companies such as The Trade Desk, Turn, Atlas, DoubleClick.Net, AOL-Time Warner Online Advertising, AppNexus, Chango, Neustar AdAdvisor, DemDex, Dstillery, BlueKai, Resonate Insights, Yahoo Publisher Network, Yield Manager, Google Adsense for Search, Yahoo Small Business, Facebook Custom Audiences, Bizo, LinkedIn Ads, Simpli.fi, Google Remarketing, DoubleClick Bid Manager.

Only 23years