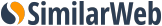

Chime (chimebank.com) is a San Francisco-based startup with a mission to help our members lead healthier financial lives. Chime is the leading challenger mobile bank account in the U.S. designed to help people avoid fees, save money automatically, and improve their finances. WeÍve created a new approach to banking that doesnÍt rely on fees or profit from membersÍ misfortune or mistakes. Chime Members get a debit card, a Spending Account, a Savings Account, and a powerful app that makes financial automation simple and keeps members in control. The Chime app is available for iPhone and Android devices and has been featured as one of the best new Money Management apps on the App Store.

Sign up today: www.chimebank.com

- Company Name:Chime - Mobile Banking

(View Trends)

-

Headquarters: (View Map)San Francisco, CA, United States

-

Financial Services

-

10 - 50 employees

- 91035 Global Rank

- 17367 United States

- 143 K Estimated Visits

-

Direct66.37%

-

Search23.75%

-

Referrals9.88%

-

Display0.00%

-

Mail0.00%

-

Social0.00%

-

90.12%

-

9.88%

- United States 95.6%

- India 0.7%

- Canada 0.5%

- Pakistan 0.3%

- Počítače

- Na webu

- Webové aplikace

- Správci záložek

- 100 SDKs

- 4.74 Avg. Rating

- 568 Total reviews

- App Url: https://itunes.apple.com/app/chime-mobile-banking/id836215269

- App Support: https://chime.zendesk.com/hc/en-us

- Genre: Finance

- Bundle ID: com.1debit.ChimeProdApp

- App Size: 56.9 M

- Version: 5.15

- Release Date: March 15th, 2014

- Update Date: October 27th, 2017

Description:

Chime is one of the fastest-growing bank accounts in the U.S.

No hidden bank fees, get your paycheck up to 2 days early* with direct deposit, grow your savings automatically, and manage your finances like a boss using the Chime mobile banking app.

When you bank with Chime, you get a Visa® Debit Card, a Spending Account, and an optional Savings Account to help you save money. Signing up is free and takes less than 2 minutes. Welcome to a better way to bank.

Here’s what our members love most about Chime:

• Get your paycheck up to 2 days early with direct deposit*

• No unnecessary fees (no service fees, no foreign transaction fees)

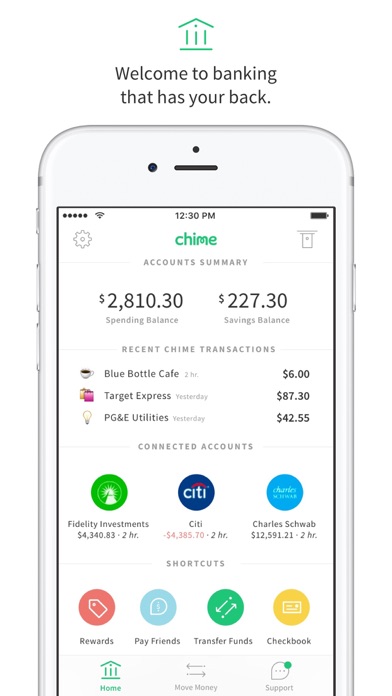

• Over 30,000 fee-free Moneypass ATMs

• No minimum balance requirements

• No overdraft

• Real time transaction notifications

• Daily balance alerts

• Block your card instantly in-app

• Grow your savings automatically with our Savings Account

• Send money to family & friends instantly with Pay Friends

• Deposit checks using Mobile Check Deposit

• Apple PayTM for when you forget your wallet

• Move money between your other bank accounts

• EMV chip card security

• Friendly and responsive customer support

With the Chime mobile banking app, you can stay in control of your money. Track your spending, link your other bank accounts, and save money.

It’s a bank account and debit card built for the digital age. - TechCrunch

Best alternative bank [account]. Unlike other savings apps, Chime doesn’t just want to help save you money — it wants to be your new bank [account]. - Nerdwallet

How to switch banks:

• Step 1: Open Your Account: Download the app and sign up. Once approved, we’ll send you your Chime card within two weeks!

• Step 2: Fund Your Account: Set up direct deposit with your employer to have funds deposited to your Chime account every payday. You can also connect other bank accounts and transfer funds from your existing bank account.

• Step 3: Update Bill Payments: Activate your card when it arrives, add it to Apple Pay, and set up recurring bill payments with your Chime card number or with your Chime account and routing numbers.

Opening a Chime bank account won’t impact your credit score. For more information please visit www.chimebank.com.

Note: Continued use of GPS running in the background can dramatically decrease battery life.

Banking Services provided by The Bancorp Bank, Member FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

*Faster access to funds is based on a comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct Deposit and earlier availability of funds are subject to payer’s support of the feature and timing of payer’s funding.

Sort by

Kitty lord supreme

Blittzed

Great but....

bhebert008

Awesome

_keianna

Absolutely favorite!

Kre8ter1

The Best Prepaid Banking!!!

Memo___

App keeps crashing

CCScrollView

CCScrollView

CocoaDebug

CocoaDebug

FLAnimatedImage

FLAnimatedImage

GLKit

GLKit

M13ProgressSuite

M13ProgressSuite

Media Player Framework

Media Player Framework

Photos Framework

Photos Framework

QBImagePickerController

QBImagePickerController

RSKImageCropper

RSKImageCropper

TheSidebarController

TheSidebarController

UserNotifications Fram...

UserNotifications Fram...

-

Native61.74%

-

Standard37.58%

-

Direct0.67%

Customer support