LendingClub is America's largest online marketplace connecting borrowers and investors, facilitating personal loans, business loans, and financing for elective medical procedures and K-12 education and tutoring. Borrowers access lower interest rate loans through a fast and easy online or mobile interface. Investors provide the capital to enable many of the loans in exchange for earning interest. We operate fully online with no branch infrastructure, and use technology to lower cost and deliver an amazing experience. We pass the cost savings to borrowers in the form of lower rates and investors in the form of attractive returns. WeÍre transforming the banking system into a frictionless, transparent and highly efficient online marketplace, helping people achieve their financial goals every day.

Since launching in 2007 weÍve built a trusted brand with a track record of delivering exceptional value and satisfaction to both borrowers and investors. LendingClubÍs awards include being named to the Inc. 500 in 2014 and a CNBC Disruptor 50 for the second year in a row, one of ForbesÍ AmericaÍs Most Promising Companies three years in a row, one of The WorldÍs 10 Most Innovative Companies in Finance by Fast Company in 2013 and a 2012 World Economic Forum Technology Pioneer.

(Notes by Prospectus - https://www.lendingclub.com/info/prospectus.action)

- Company Name:Lendingclub

(View Trends)

-

Headquarters: (View Map)San Francisco, CA, United States

-

Internet

-

1,000 - 5,000 employees

- 16712 Global Rank

- 3158 United States

- 2.98 M Estimated Visits

-

Direct70.30%

-

Search21.56%

-

Mail4.26%

-

Referrals2.72%

-

Social0.78%

-

Display0.38%

-

96.00%

-

0.49%

-

0.30%

-

0.22%

-

0.20%

- United States 90.1%

- Hong Kong 3.4%

- Canada 2.0%

- Saudi Arabia 1.1%

- India 1.0%

- Edmonds

- 10 SDKs

- 3.1 Avg. Rating

- App Url: https://itunes.apple.com/app/lending-club/id1220590624

- App Support: https://www.lendingclub.com/site/investing/solid-returns

- Genre: Finance

- Bundle ID: com.lc.investorApp

- App Size: 40.1 M

- Version: 1.4.7

- Release Date: April 12th, 2017

- Update Date: October 17th, 2020

Description:

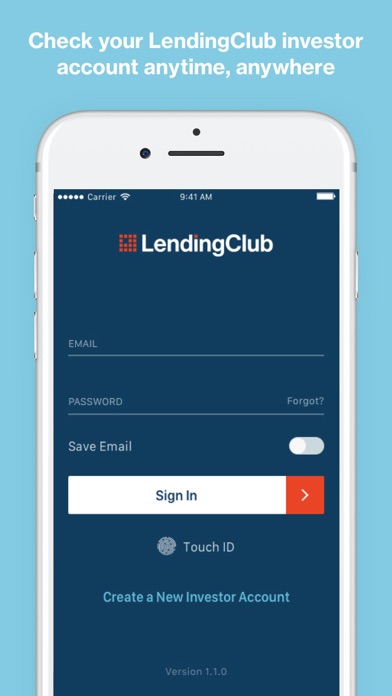

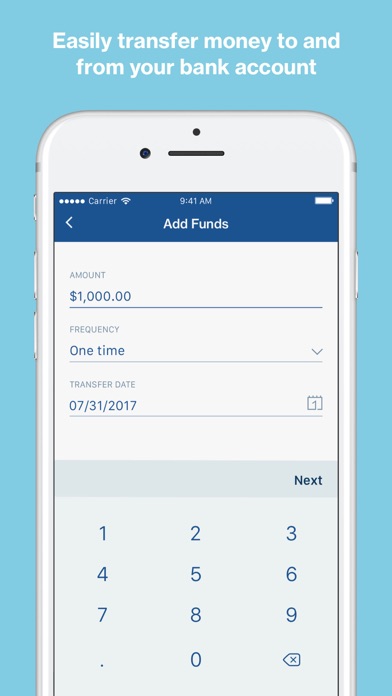

Access your LendingClub investor account through a convenient experience optimized for your mobile device. Don’t miss a thing - access your account whenever and wherever you want to.

Now you can:

- Log in to your account with a touch of the finger

- View and manage your account

- See your Net Annualized Return (NAR)

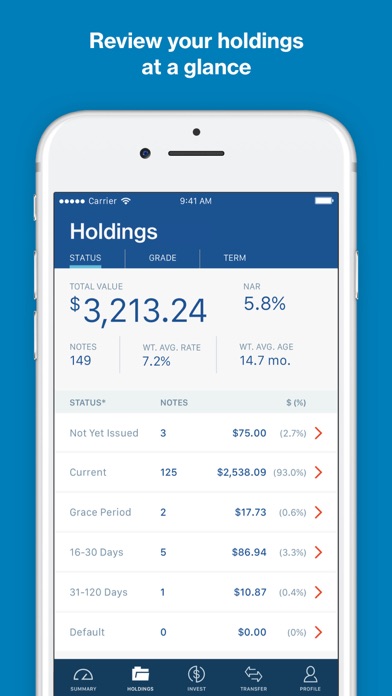

- Invest in Notes

- Use your saved filters to find the Notes you want

- Set up and update automated investing

- Transfer money between your LendingClub account and your bank

INVESTING THROUGH LENDINGCLUB

As the trailblazer in the marketplace lending industry, we've evolved into the world's largest online credit marketplace. Through LendingClub, individual investors have access to the consumer credit asset class. Historically, this alternative asset class has only been available to banks and large institutions. As borrowers make monthly payments on their loans, investors can make monthly returns through an automated investing strategy or by selecting Notes manually.

SHARE YOUR FEEDBACK

Leave us a review and let us know what you’d like to see next. We hope you enjoy the experience and look forward to hearing your comments.

-

Native7.41%

-

Standard92.59%

-

Direct0.00%

They are headquartered at San Francisco, CA, United States, and have 3 advertising & marketing contacts listed on Kochava. Lendingclub works with Advertising technology companies such as mediaFORGE, Rubicon Project, Yield Manager, Google Adsense, Facebook Exchange FBX, Yahoo Small Business, Facebook Custom Audiences, AppNexus, AppNexus Segment Pixel, Google Remarketing, DoubleClick.Net, AdRoll, DoubleClick Bid Manager, Aggregate Knowledge, Neustar AdAdvisor, ExactTarget, Dstillery, The Trade Desk.